Implications of the Tax Cut and Jobs Act (TCJA) Sunsetting

The Tax Cuts and Jobs Act of 2017 (TCJA) introduced significant changes to many tax provisions. However, most of those provisions are set to sunset for the 2026 tax year unless Congress extends them.

List of Notable Provisions that are Sunsetting in 2026

- Tax brackets were lowered, and some income ranges were adjusted as well

Before TCJA During TCJA 10% 10% 15% 12% 25% 22% 28% 24% 33% 32% 35% 35% 39.6% 37%

- The standard deduction was nearly doubled, but personal exemptions were removed

- The child tax credit was doubled from $1,000 to $2,000, and the phaseout threshold increased from $75k (unmarried) / $110k (married) to $200k (unmarried) / $400k (married)

- A cap of $10,000 for state and local taxes (SALT) was set for itemized deductions

- The maximum amount of mortgage debt eligible for the interest deduction was reduced from $1,000,000 to $750,000

- Miscellaneous itemized deductions above 2% of AGI were removed

- Pease limitation of itemized deductions was removed. Before TCJA, you had to reduce your itemized deductions by $0.03 for every dollar earned above the threshold amount ($320k for MFJ, $267.7k for S in 2018). This was limited to a maximum reduction of 80% of your itemized deductions

- AMT exemptions and phaseouts were greatly increased during TCJA, bringing many Americans out of paying AMT

- 20% Qualified Business Income (QBI) deduction under Section 199A was added

- The base gift/estate tax exemption amount increased from $5,000,000 to $10,000,000 with TCJA

List of Notable Provisions that Currently not Scheduled to Expire

- Corporate tax rate was lowered to a flat 21% rate instead of a progressive tax bracket system with a top rate of 35%

- The inflation rate that the IRS uses to adjust their numbers was changed from the CPI-U to the Chained CPI-U (C-CPI-U), which typically grows more slowly than the CPI-U since it takes into account the change in consumer behavior (consumers are less likely to purchase goods that increase in price)

- Alimony payments for divorces after December 31, 2018, are not tax-deductible, and the recipients do not report it as taxable income.

- Roth conversions are not reversible and are final once completed.

Impact on Taxpayers

Taxpayers who pay a high amount of state & local taxes (income & property) will once again be able to claim above $10,000 of SALT for itemized deductions. However, this will be reduced by the Pease limitation for those taxpayers over the threshold. They’ll have to add 3 cents of income for every dollar above the threshold up until 80% of their itemized deductions. In most cases, this acts as a slight marginal tax rate increase of 1.18% maximum for income above the threshold. This is because itemized deductions generally scale with your income, and since the top marginal rate is 39.6%, an additional 3 cents of income would equate to an increase of 1.18% in federal taxes.

However, many itemized deductions, including SALT, are an add-back item for AMT purposes. Pre-TCJA, the AMT exemptions and phaseout thresholds were significantly lower, and many more Americans were subject to AMT. Even though taxpayers can save more with itemized deductions, there may be scenarios where you pay a significant amount of AMT. Some notable exceptions to AMT add-back for itemized deductions are mortgage interest & charitable deductions.

Estimated 2026 Tax Brackets & Items

Below are our estimated tax brackets and various tax items for 2026.

TCJA Remains in 2026

| Tax Bracket | Single | Married Filing Jointly |

| 10% | $0 – $12,200 | $0 – $24,425 |

| 12% | $12,201 – $49,675 | $24,426 – $99,350 |

| 22% | $49,676 – $105,925 | $99,351 – $211,850 |

| 24% | $105,926 – $202,225 | $211,851 – $404,450 |

| 32% | $202,226 – $256,775 | $404,451 – $513,575 |

| 35% | $256,775 – $642,000 | $513,576 – $770,375 |

| 37% | $642,001+ | $770,376+ |

- Standard Deduction: $15,350 Single, $30,750 MFJ

- AMT Exemption: $90,300 Single, $140,400 MFJ

- AMT Phase-Out Threshold: $642,000 Single, $1,284,000 MFJ

- AMT 28% Bracket: $245,050

TCJA Sunsets in 2026

| Tax Bracket | Single | Married Filing Jointly |

| 10% | $0 – $12,150 | $0 – $24,325 |

| 15% | $12,151 – $49,500 | $24,326 – $99,000 |

| 25% | $49,501 – $119,875 | $99,001 – $199,725 |

| 28% | $119,876 – $250,000 | $199,726 – $304,400 |

| 33% | $250,001 – $543,600 | $304,401 – $543,600 |

| 35% | $543,601 – $545,800 | $543,601 – $614,050 |

| 39.6% | $545,801+ | $614,051+ |

- Standard Deduction: $8,250 Single, $16,550 MFJ

- Personal Exemption: $5,250

- Pease Income Threshold: $341,100 Single, $409,350 MFJ

- AMT Exemption: $70,800 Single, $110,250 MFJ

- AMT Phase-Out Threshold: $157,450 Single, $209,900 MFJ

- AMT 28% Bracket: $245,050

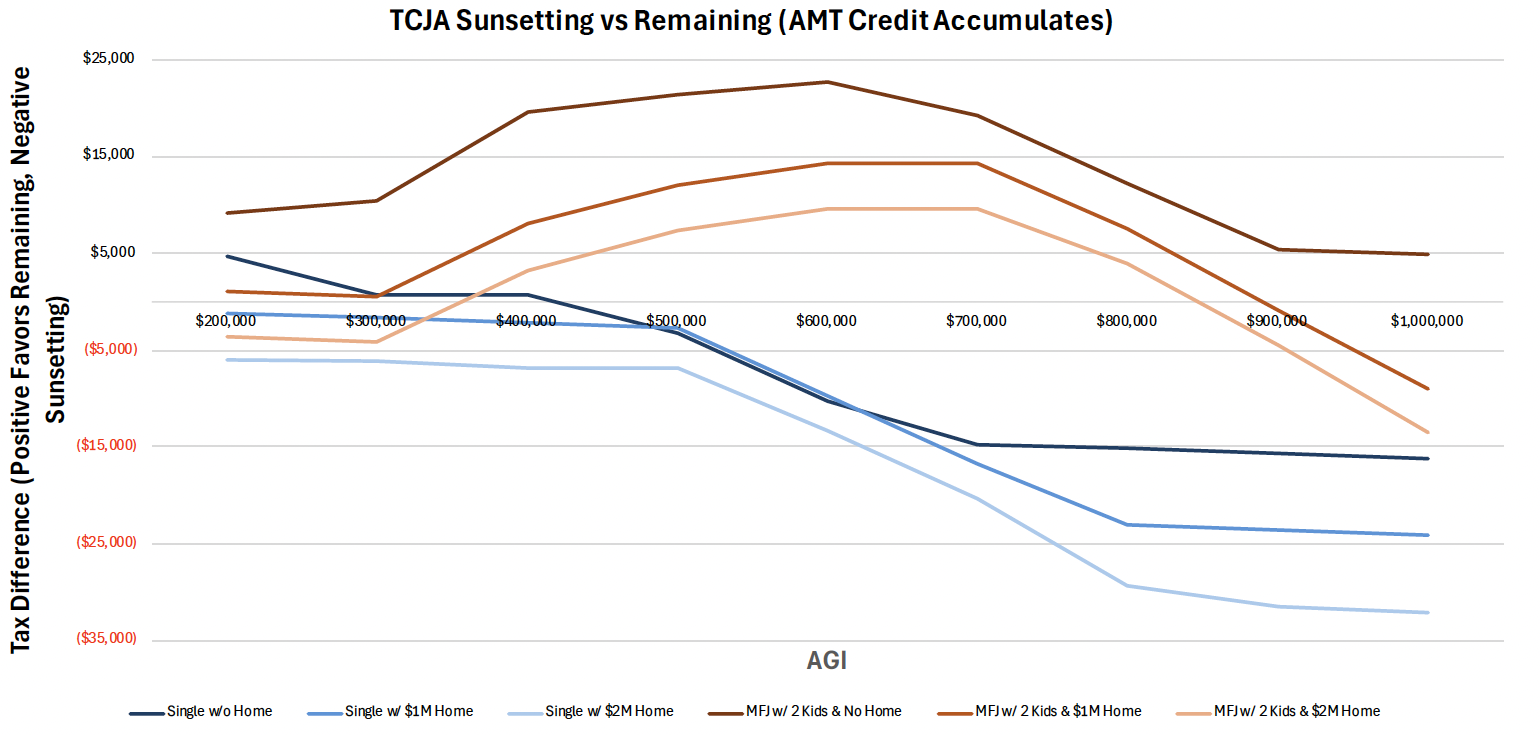

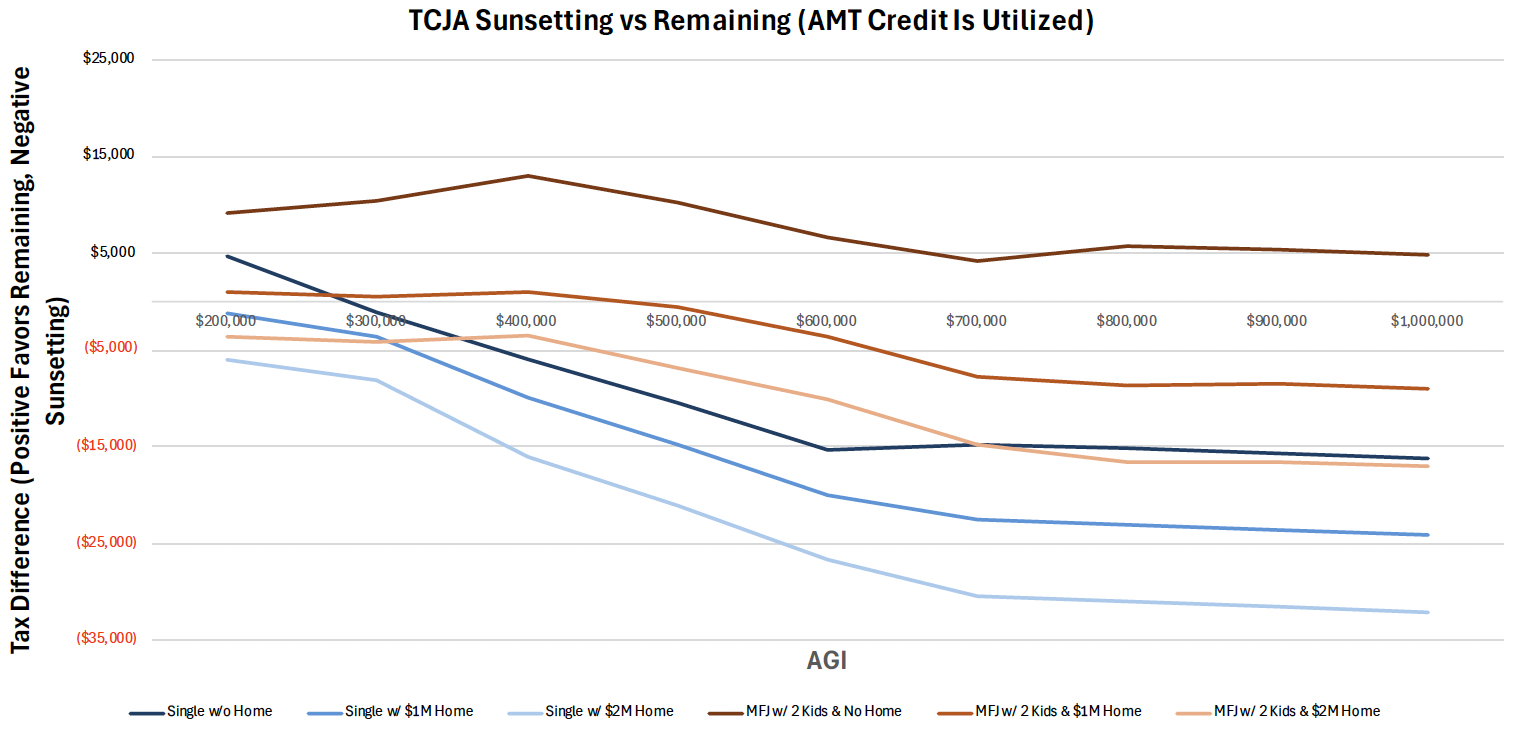

Visualizing Tax Impacts if TCJA Sunsets or Remains

To assess the impact of TCJA sunsetting in 2026, we have various scenarios below for those filing Single / Married Filing Jointly across taxpayers who are not homeowners, own a $1M home, or own a $2M home. The single cases have 0 dependents, while the MFJ cases have 2 dependents. We also assume the taxpayers are living in New York City. We have examined W-2 incomes from $200k to $1M with even $100k increments.

For the $1M home case, we assume an $800k 30-yr 6.60% loan in the first year, generating $52,500 of mortgage interest & $10,000 of property taxes. For the $2M home case, we assume a $1.6M 30-yr 6.60% loan in the first year, generating $107,000 of mortgage interest and $20,000 of property taxes. Using the above brackets, tax provisions, and relevant changes, we calculated the net federal taxes and took the difference between TCJA sunsetting or remaining.

There are some cases where AMT is paid. All of these AMT cases in our scenarios only happen if TCJA sunsets. It is reclaimable in future tax years as a tax credit only if your AMT in that future tax year is lower than your regular tax liability. Otherwise, it will continue to accumulate as a carryover credit.

Conclusion

As we can see from the cases above, our single New York City taxpayer generally benefits more if TCJA sunsets. However, for married couples filing jointly with two dependents in NYC, it is a more complicated situation. If we exclude the AMT credit that you get (since if the makeup of your income doesn’t change in the future, you generally will not reclaim the credit), most times it’s better for TCJA to not sunset. If we include the AMT credit to offset some of the tax difference, in many cases it’s better for TCJA to sunset. How your income changes in the future as well as careful tax planning of distributions in pre and post-retirement will determine how effectively you can utilize an AMT credit.

One big takeaway is that the outcomes depend heavily on particular circumstances unique to each taxpayer. Therefore, the above cases shouldn’t be used as general guidelines to follow, but more to highlight the complexities in the variances.

It is essential to evaluate your tax situation and determine if any adjustments are necessary in anticipation of potential changes to tax law. It is also important to remember that new tax law could be passed, which could be a mixture of these two scenarios or even add/modify the tax code in an entirely different way. For some taxpayers, it may be beneficial to accelerate income, such as realizing a taxable gain or selling property, in 2025 to take advantage of the more favorable AMT brackets currently available. Conversely, other taxpayers might benefit from deferring income and avoiding additional taxable gains. By understanding how your taxes will be affected under both scenarios, as well as remaining flexible to potential new changes, you can take prompt action in 2025 once the tax code becomes set for the 2026 tax year.

Sources

Article Post Disclaimer

Astra Wealth Partners LLC is a registered investment adviser registered with the United States Securities and Exchange Commission.

Registration does not imply a certain level of skill or training. The views and opinions expressed are as of the date of publication and are subject to change. The content of this publication is for informational or educational purposes only. This content is not intended as individualized investment advice, or as tax, accounting, or legal advice. Although we gather information from sources that we deem to be reliable, we cannot guarantee the accuracy, timeliness, or completeness of any information prepared by any unaffiliated third-party. When specific investments or types of investments are mentioned, such mention is not intended to be a recommendation or endorsement to buy or sell the specific investment.

The author of this publication may hold positions in investments or types of investments mentioned. This information should not be relied upon as the sole factor in an investment-making decision. Readers are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.