Enhancing the Tax Benefits of Direct Indexing with a Short Overlay Strategy

Direct Indexing General Background

Direct indexing has been gaining in popularity in recent years. This strategy involves creating a portfolio of individual stocks that tracks a chosen index (such as the S&P 500) to increase tax efficiency. The concept is that, on average, most individual stocks will increase in value in a given year, but a significant portion will decrease, even when the index rises. This allows capital losses to be harvested while tracking the index relatively closely.

Since mutual funds and ETFs cannot pass through these tax losses to end investors, replicating an index utilizing individual stocks in a separately managed account allows the investor to take advantage of harvesting losses at the individual stock level. The investor can then use these losses to offset capital gains generated elsewhere in the portfolio or to diversify appreciated positions.

Adding a Short Component to the Direct Indexing Account

When an investor expects a substantial capital gain or receives short-term capital gains regularly, adding short positions can provide additional opportunities for tax loss harvesting. In a rising market, opportunities to tax loss harvest long positions are less abundant, and realized capital gains tend to be more common in the portfolio as a whole. It can make sense to tax loss harvest short positions similarly to long positions, where the short position is “bought to close,” and a new short, which is not substantially identical to the first short, is opened.

When adding a short position to a 100% long stock portfolio, the stock exposure is reduced by the amount of the short position. For example, if a portfolio is 100% long an S&P 500 ETF and 25% short a NASDAQ ETF, the new exposure would be equivalent to 75% S&P 500, 25% “synthetic bond,” and 25% the S&P 500 – NASDAQ 100 returns. Further down the article is an additional explanation for the “synthetic bond” concept.

To help illustrate, here is an example starting portfolio:

- 30% US Large Cap Stocks S&P 500 Direct Indexing Account

- 30% Investment Grade Bonds

- 40% in US Small/Mid and Foreign Equities

Making the following changes:

- Transfer 10% of the portfolio from bonds (1/3 of the bonds) to the S&P 500 Direct Indexing Account, purchasing individual stock components of the index. The Direct indexing portfolio now represents 40% of the portfolio.

- Start a short position in Nasdaq-100 ETF (QQQ) equal to 10% of the portfolio (equivalent to 25% of the direct indexing portfolio)

The following new portfolio with similar net large-cap exposure to the original portfolio (40% Long S&P 500 / 10% Short Nasdaq-100):

- 30% US Large Cap Stocks

- Composition 40% S&P 500 – 10% Nasdaq-100

- 30% Fixed Income

- 10% Bond Equivalent or “Synthetic Bond” from the overlapping 10% long/short

- 20% Traditional Investment Grade Bonds

- 40% in US Small/Mid and Foreign Equities

How would the composition of the S&P 500 portion of the portfolio change when adding the 25% short Nasdaq-100 ETF?

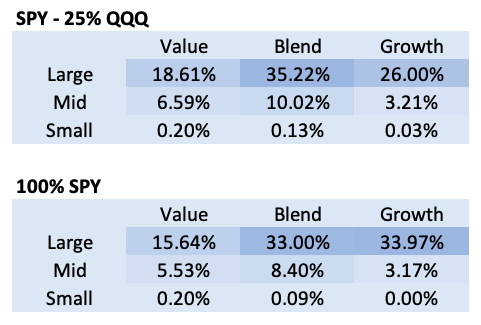

The resulting portfolio would not look radically different from the S&P 500. The new portfolio composition would have a higher weighting towards value and mid-cap stocks than the S&P 500, per the style chart and the top 25 stock weighting below. This is because the NASDAQ-100 tends to have a higher weight towards large growth stocks than the S&P 500, which is adjusted downward when shorting the NASDAQ-100 index.

Style Charts

Top 25 Holdings for SPY vs QQQ Short

| Ticker | SPY Weight | SPY- 25% QQQ Weight | 75% SPY Weight |

| AAPL | 6.99% | 4.28% | 5.25% |

| MSFT | 6.49% | 4.12% | 4.87% |

| AMZN | 3.19% | 1.87% | 2.40% |

| NVDA | 2.93% | 1.86% | 2.20% |

| GOOGL | 2.16% | 1.37% | 1.62% |

| TSLA | 1.85% | 1.08% | 1.39% |

| GOOG | 1.85% | 1.07% | 1.39% |

| META | 1.85% | 0.90% | 1.39% |

| BRK.B | 1.82% | 1.82% | 1.37% |

| XOM | 1.34% | 1.34% | 1.01% |

| UNH | 1.30% | 1.30% | 0.98% |

| LLY | 1.22% | 1.22% | 0.92% |

| JPM | 1.18% | 1.18% | 0.89% |

| JNJ | 1.06% | 1.06% | 0.79% |

| V | 1.03% | 1.03% | 0.77% |

| PG | 0.97% | 0.97% | 0.73% |

| AVGO | 0.94% | 0.20% | 0.71% |

| MA | 0.92% | 0.92% | 0.69% |

| CVX | 0.85% | 0.85% | 0.64% |

| HD | 0.85% | 0.85% | 0.64% |

| ABBV | 0.75% | 0.75% | 0.57% |

| MRK | 0.74% | 0.74% | 0.55% |

| COST | 0.70% | 0.15% | 0.52% |

| PEP | 0.65% | 0.14% | 0.49% |

| WMT | 0.64% | 0.64% | 0.48% |

Why do offsetting long and short positions create a “synthetic bond”?

The mathematics behind this calculation is based on the same theory in our Box Spreads article. First, we’ll start with the mechanics of short selling. When you sell a stock short, you’ll need to borrow the stock before selling, which is typically at a low rate for easier-to-borrow stocks and ETFs (for example, on Interactive Brokers, QQQ had a 0.27% borrowing cost on 10/19/23 and SPY had a 0.26% to borrowing cost on 10/19/23).

Certain brokers, such as Interactive Brokers, will pay interest on short proceeds if the sum of short positions in a portfolio is large enough (the below is based on short balances). For example, as of 10/5/23, the below are the rates for interest paid at Interactive Brokers:

| Tier | Rate Paid (IBKR Pro) |

| $0 – $100,000 | 0.00% |

| $100,000.01 – $1,000,000 | 4.08% (BM – 1.25%) |

| $1,000,000.01 – $3,000,000 | 4.83% (BM – 0.50%) |

| $3,000,000.01+ | 5.08% (BM – 0.25%) |

Therefore, if you are short $200,000 of stock with a .25% borrowing fee, you would pay 0.25% on the first $100K and receive 4.08% – 0.25% on the next $100K, averaging 1.79%. Applying the same math to $1,000,000 short stock would result in 3.42% of proceeds on short interest. You must pay dividends to the long stock or ETF holder when short.

Instead of shorting stock, we could turn to the options market and create a “synthetic short,” which has a payoff equivalent to short stocks or ETFs. A synthetic short is created by selling a call and purchasing a put at the same strike and maturity. Synthetic short positions on easy-to-borrow stocks reflect the short interest the short seller would have received with a higher breakeven place than the price at the time of entry. Here is some actual market data from October 19, 2023, at 1:42 PM EST to demonstrate the dynamics:

QQQ January 27, 2025 Options with No Price Improvement

| Strike | Call Bid | Call Ask | Put Bid | Put Ask | (Debit) / Credit | Breakeven | Breakeven % | Annualized Breakeven % | Annualized Breakeven % (with Dividends) |

| 425 | 18.03 | 18.56 | 64.02 | 65.34 | -47.33 | 377.67 | 4.19% | 3.35% | 3.95% |

| 400 | 27.90 | 28.60 | 46.81 | 47.97 | -20.09 | 379.91 | 4.81% | 3.85% | 4.45% |

| 375 | 40.45 | 41.25 | 34.11 | 34.92 | 5.51 | 380.51 | 4.97% | 3.98% | 4.58% |

| 350 | 55.30 | 56.22 | 24.46 | 24.91 | 30.37 | 380.37 | 4.93% | 3.95% | 4.55% |

| 325 | 72.05 | 73.25 | 17.34 | 17.96 | 54.07 | 379.07 | 4.57% | 3.66% | 4.26% |

| 300 | 90.40 | 91.67 | 12.03 | 12.45 | 77.93 | 377.93 | 4.26% | 3.41% | 4.01% |

QQQ January 27, 2025 Options with Midpoint Improvement

| Strike | Call Bid | Call Ask | Put Bid | Put Ask | (Debit) / Credit | Breakeven | Breakeven % | Annualized Breakeven % | Annualized Breakeven % (with Dividends) |

| 425 | 18.03 | 18.56 | 64.02 | 65.34 | -46.41 | 378.60 | 4.44% | 3.56% | 4.16% |

| 400 | 27.90 | 28.60 | 46.81 | 47.97 | -19.16 | 380.84 | 5.06% | 4.05% | 4.65% |

| 375 | 40.45 | 41.25 | 34.11 | 34.92 | 6.32 | 381.32 | 5.19% | 4.16% | 4.76% |

| 350 | 55.30 | 56.22 | 24.46 | 24.91 | 31.06 | 381.06 | 5.12% | 4.10% | 4.70% |

| 325 | 72.05 | 73.25 | 17.34 | 17.96 | 54.98 | 379.98 | 4.82% | 3.86% | 4.46% |

| 300 | 90.40 | 91.67 | 12.03 | 12.45 | 78.78 | 378.78 | 4.49% | 3.60% | 4.20% |

Comparing Short Positions with Synthetic Shorts

In the current environment with the Fed Funds rate above 5%, the short interest generated from short positions becomes much more critical than when rates were near 0%. Given that most retail brokers pay no interest on short proceeds, it is essential to consider the potentially significant lost interest compared to a synthetic short. In cases where interest on short proceeds is provided, this interest would be taxed as ordinary income, which may be less favorable than the pure capital gains treatment provided by the synthetic short position.

Synthetic short positions have a higher breakeven price (a benefit for a short position) when compared to the price at the time of shorting (assuming the stock or ETF is easy to borrow), which is typically effectively the same as receiving interest on short proceeds. All of the dynamics are reflected in the options pricing, which allows for capital gains treatment instead of ordinary income treatment, which can be beneficial.

Tax Treatment of Short Positions and Synthetic Short Positions

Short stock positions are always treated as short-term capital gains or losses when realized, even if the holding period is over a year. The broker could call back a short position at any time (although relatively uncommon with a highly liquid position), which would trigger a short-term gain. Otherwise, you could hold the short position indefinitely, assuming you maintained the margin requirements.

On a short synthetic, a long put held for more than a year would trigger long-term capital gains, while a short call would always be treated as short-term capital gains. For a synthetic short, the higher the strike price, the deeper in the money the put becomes. The maximum profit on a short call is the premium received, so as the strike price goes up, the maximum short-term capital gain decreases.

Which Strikes Makes the Most Sense on a Synthetic to Maximize Tax Efficiency?

As you can see from the charts above, the breakeven is highest at the strikes “near the money” or closest to the current stock price (a higher breakeven is preferred when taking a short position, all else equal). We can safely eliminate the strikes significantly below the current price when constructing a short for tax purposes, given the short-call side is significant, creating the possibility for a significant short-term capital gain.

The calculations become more complicated as the strikes above the current stock price require the investor to provide cash, and the breakeven price is slightly lower (which is unfavorable when short). On the other hand, the higher the strike price, the higher the probability of generating long-term capital gains, which is a desirable outcome when the price increases. Selecting the right strike, whether near the money or above, will require careful analysis of the circumstances and objectives.

Avoiding Tax Straddles

Tax straddles have several consequences, including resetting holding periods for long-term capital gains and deferring realized losses until the side with a gain is closed. Triggering a tax straddle would likely eliminate the benefits of the strategy outlined in this article.

Tax straddles are triggered when the long side of the portfolio has the tax code definition of “Substantial Overlap” with the short side. The threshold for “Substantial Overlap” for a portfolio of stocks, or an ETF holding a portfolio of stocks, is 70% capitalization-weighted. For example, as of 10/18/2023, the SPDR S&P 500 ETF TRUST (SPY) and Vanguard Total Stock Market Index ETF (VTI) have 86% capitalization weighted overlap and would likely trigger the tax straddle rules with offsetting positions. SPDR S&P 500 ETF TRUST (SPY) and Invesco Nasdaq-100 ETF (QQQ) have a 44% capitalization-weighted overlap. These positions would not likely trigger the tax straddle rules, assuming other positions in the portfolio did not create offsetting positions.

Tax Loss Harvesting on the Short Side

Similarly to long investments, you can also tax loss harvest on the short side. You would need to close out the initial short position and switch to a new correlated position but not “Substantially Identical” (which is a different standard than the “Substantial Overlap” standard for straddles) as the tax code indicates. You would also need to ensure the new short position doesn’t trigger a tax straddle compared to the long positions in the portfolio.

If implementing via options, you need to ensure both the original position and any tax-loss harvesting pairs have a liquid options market with long-term options, which is usually only the case for ETFs and stocks with high trading volume.

When Does This Make Sense for an Investor?

Adding short positions adds a new level of portfolio and tax complexity, so it is essential to consider whether this would add value for an investor. This strategy would require adding margin and options if utilizing the synthetic short overlay. Here are some situations where this enhanced direct indexing strategy may be worth considering:

- An investor holds investments that generate significant short-term capital gains regularly and does not have offsetting capital losses from other sources.

- An investor expects significant capital gains from selling a concentrated stock, closely held business, or real estate holding. An aggressive tax loss harvesting strategy could allow the investor to reduce concentration risk with a higher degree of tax efficiency.

Risks

- Options trading is generally considered a high-risk strategy for investment professionals due to the complexity involved in implementation.

- Brokers typically require margin and high-level options approval to implement these strategies. Trading and execution errors could result in significant losses.

- The examples provided do not include the impact of fees, commissions, and execution at undesirable prices.

- Investors should consult with their tax advisors to determine how the profit and loss on any options strategy will be taxed. The applicable tax laws and regulations are complex, change from time to time, and may be subject to interpretation.

Article Post Disclaimer

Astra Wealth Partners LLC is a registered investment adviser registered with the United States Securities and Exchange Commission.

Registration does not imply a certain level of skill or training. The views and opinions expressed are as of the date of publication and are subject to change. The content of this publication is for informational or educational purposes only. This content is not intended as individualized investment advice, or as tax, accounting, or legal advice. Although we gather information from sources that we deem to be reliable, we cannot guarantee the accuracy, timeliness, or completeness of any information prepared by any unaffiliated third-party. When specific investments or types of investments are mentioned, such mention is not intended to be a recommendation or endorsement to buy or sell the specific investment.

The author of this publication may hold positions in investments or types of investments mentioned. This information should not be relied upon as the sole factor in an investment-making decision. Readers are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.